Markets

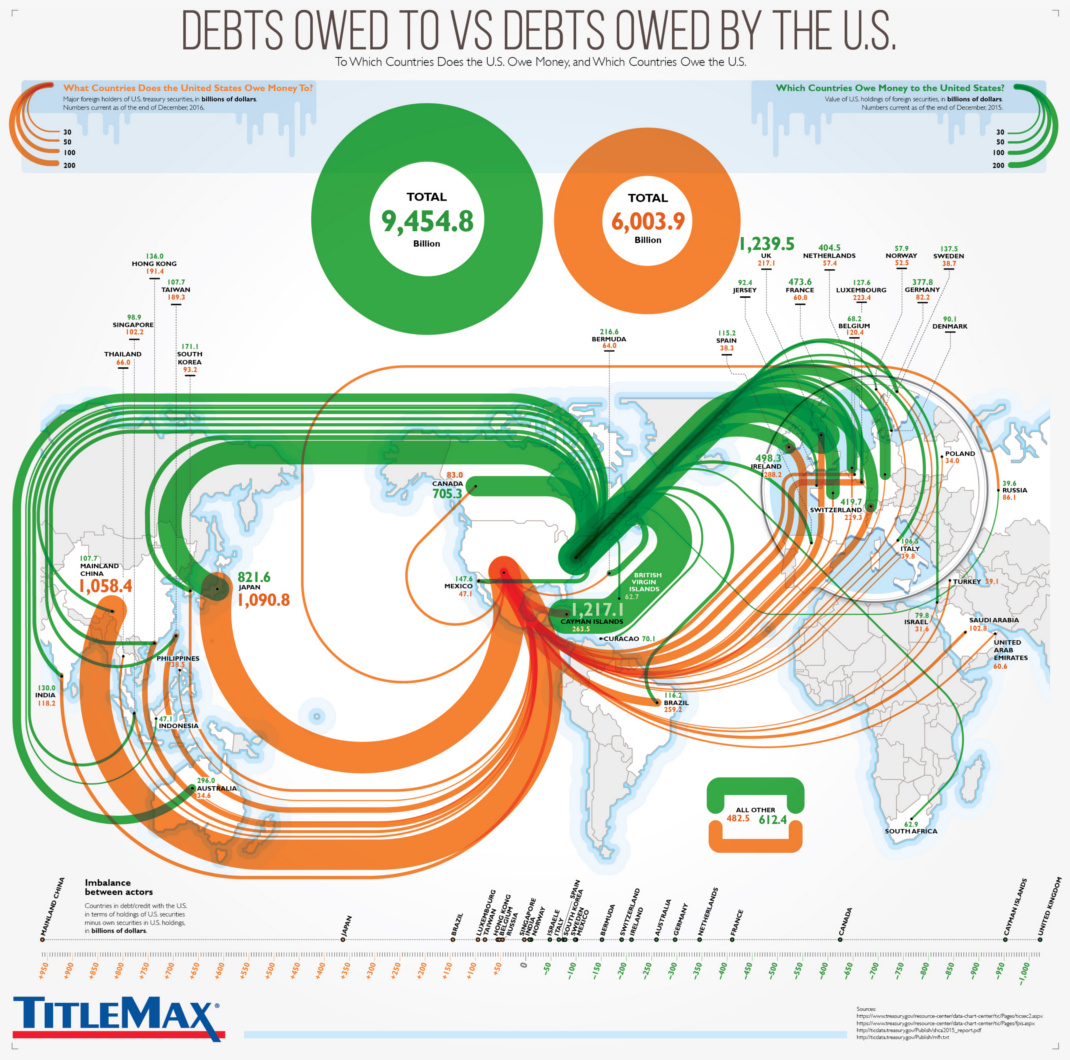

Visualizing Who Holds U.S. Debt Internationally

Visualizing Who Holds U.S. Debt Internationally

We recommend viewing the full-size version of today’s infographic by clicking here.

Everyone knows that the U.S. Federal Government has roughly $20 trillion of debt. A question we often get, however, is who exactly owns all these treasuries? And if it’s held abroad by countries like China, what portion do they hold?

Today’s infographic comes from TitleMax, and it looks at who owns U.S. debt internationally, as well as the debt from other countries that is held by the U.S.

Who Holds U.S. Debt?

Federal government debt in the United States can be broadly placed in two categories: “Debt held by the public” and “Intragovernmental debt”. The former category includes securities held by individual investors, corporations, local and state governments, the Federal Reserve, and foreign governments.

Meanwhile, intragovernmental debt includes securities held in accounts administered by other federal authorities. This category, for example, would include treasuries owed to the Social Security Trust Fund.

Here’s the tallies of these two categories as of December 2016:

| Federal U.S. Debt (Billions) | |

|---|---|

| Debt held by the public | $14,202.1 |

| Intragovernmental debt | $5,395.7 |

| Total debt | $19,597.8 |

Debt Held By the Public

“Debt held by the public” is the most interesting of these, and it can be further broken down:

| Entity | U.S. Debt Held (Billions) |

|---|---|

| Foreign/International | $6,154.9 |

| Federal Reserve* | $2,490.6 |

| Mutual Funds | $1,524.8 |

| State and Local Gov'ts (incl. pensions) | $899.4 |

| Banks | $620.3 |

| Private pension funds | $549.1 |

| Insurance Companies | $344.8 |

| U.S. Savings Bonds | $165.8 |

| Other | $1,449.1 |

*Note: Data for Fed is for marketable securities only. All data in this table from September 2016.

About 43% of all debt held by the public is actually owned by foreign governments, corporations, and individuals.

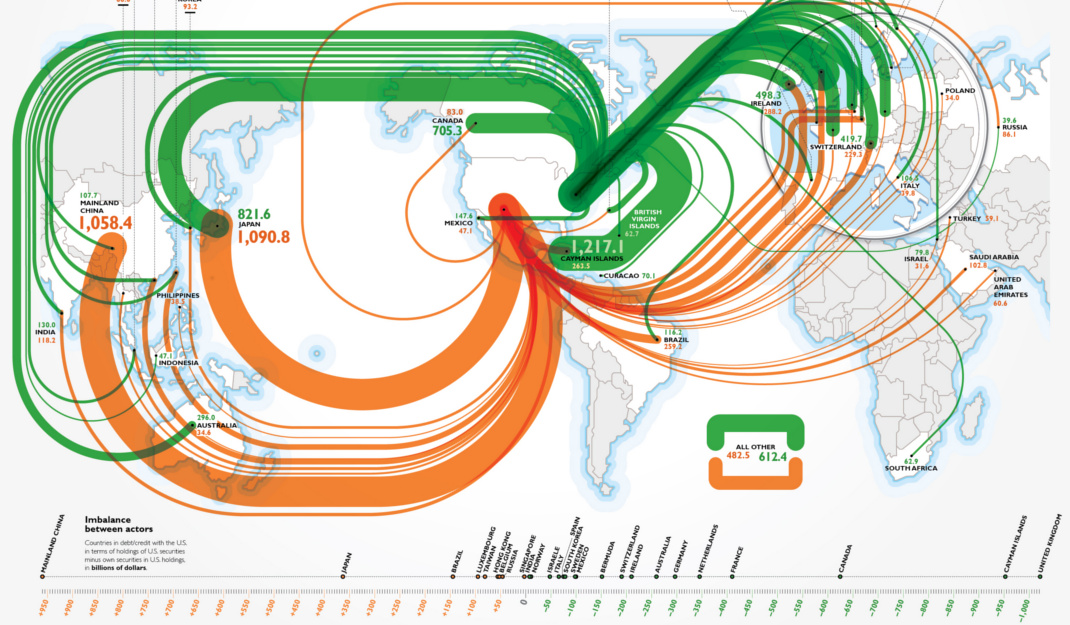

U.S. Debt Held Internationally

Here’s how that breaks down by country:

| Country | U.S. Debt Held (Billions) |

|---|---|

| Japan | $1,090.8 |

| China | $1,058.4 |

| Ireland | $288.2 |

| Cayman Islands | $263.5 |

| Brazil | $259.2 |

| Switzerland | $229.9 |

| Luxembourg | $223.4 |

| United Kingdom | $217.1 |

| Hong Kong | $191.4 |

| Taiwan | $189.3 |

| India | $118.2 |

| Saudi Arabia | $102.8 |

| Others | $1,771.7 |

Note: This data is from December 2016

Markets

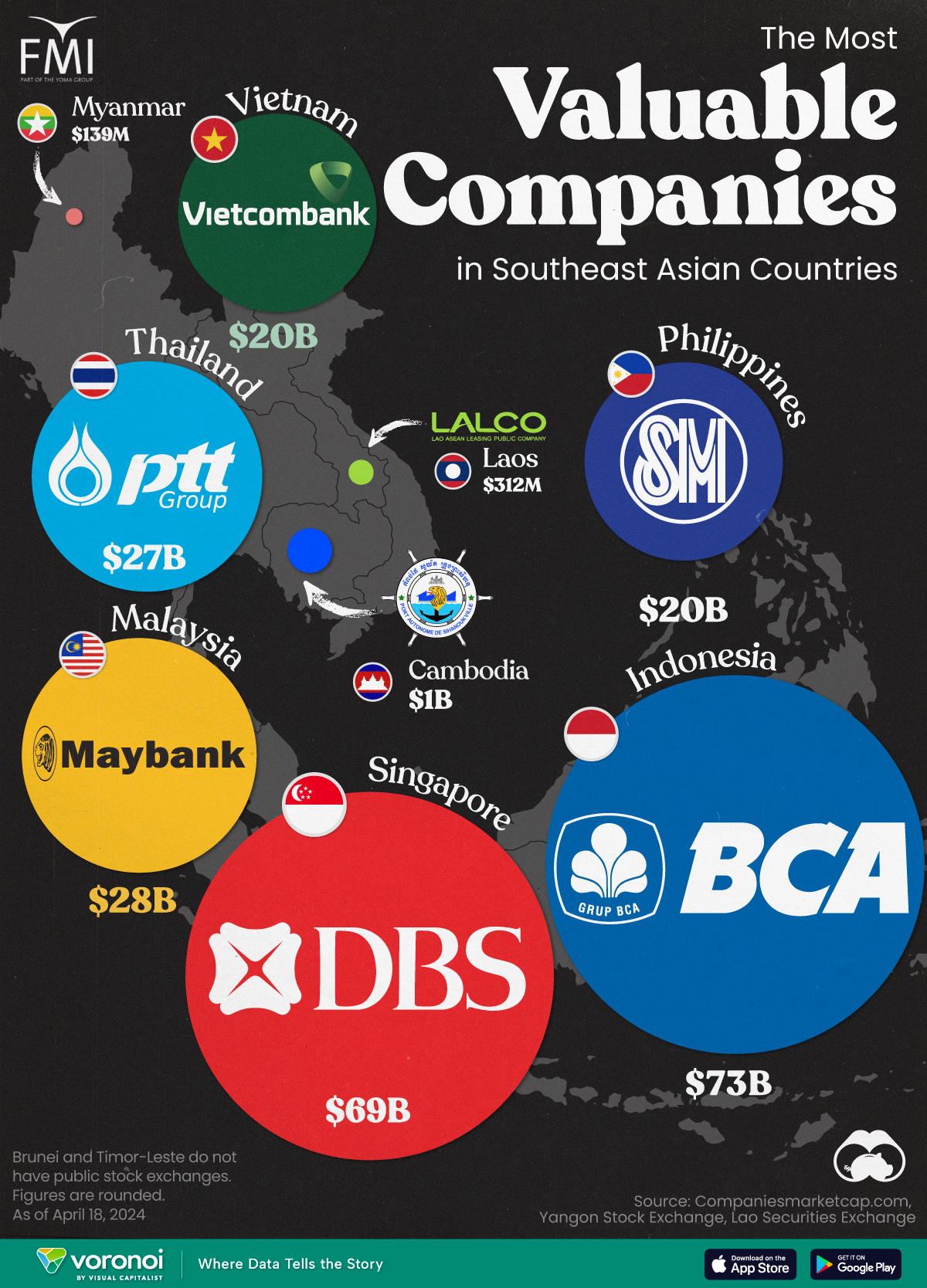

Mapped: The Most Valuable Company in Each Southeast Asian Country

Six businesses in the broader financial space are present on this list of the largest companies, by market cap, in each Southeast Asian country.

The Most Valuable Company in Each Southeast Asian Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Southeast Asia has been emerging as an economic powerhouse in the past decade. However, there are very noticeable disparities in the sizes of the largest publicly-traded corporations in countries within the region.

In this visualization, we map the most valuable company in each Southeast Asian country, by their market capitalization in current U.S. dollars as of April 18th, 2024.

Data for this visualization and article is sourced from Companiesmarketcap.com, and the Laos and Yangon stock exchanges.

Southeast Asia’s Biggest Companies are Banks

The most valuable companies in Indonesia and Singapore, Bank Central Asia and DBS Group, are each worth more than $60 billion, and both are banks.

In the quartet of Malaysia, Thailand, Vietnam, and the Philippines, the largest companies by market cap are all worth around $20 billion. Out of the four, two are banks.

| Country | Company | Market Cap |

|---|---|---|

| 🇮🇩 Indonesia | 🏦 Bank Central Asia | $73B |

| 🇸🇬 Singapore | 🏦 DBS Group | $69B |

| 🇲🇾 Malaysia | 🏦 Maybank | $28B |

| 🇹🇭 Thailand | ⛽ PTT PCL | $27B |

| 🇻🇳 Vietnam | 🏦 Vietcombank | $20B |

| 🇵🇭 Philippines | 📈 SM Investments Corporation | $20B |

| 🇰🇭 Cambodia | 🚢 Sihanoukville Autonomous Port | $1B |

| 🇱🇦 Laos | 🏭 LALCO | $312M |

| 🇲🇲 Myanmar | 📈 First Myanmar Investment | $139M |

Note: Figures are rounded, and current as of April 18th, 2024.

Cambodia stands by itself, with its most valuable publicly listed company, Sihanoukville Autonomous Port, worth $1 billion.

Meanwhile, LALCO in Laos is a credit leasing company worth $312 million and Myanmar’s biggest company, First Myanmar Investment, is worth $139 million.

Finally, Brunei and Timor-Leste do not have public stock exchanges, but for different reasons.

Most of Brunei’s economy relies on the state-owned oil sector, which also helps make its sultan the world’s second-richest monarch. However, in Timor-Leste, a small population combined with limited access to credit and liquidity has led to limited opportunities for the creation of publicly-listed companies or an exchange.

-

Economy7 days ago

Economy7 days agoRanked: The Top 20 Countries in Debt to China

-

Demographics2 weeks ago

Demographics2 weeks agoThe Countries That Have Become Sadder Since 2010

-

Money2 weeks ago

Money2 weeks agoCharted: Who Has Savings in This Economy?

-

Technology2 weeks ago

Technology2 weeks agoVisualizing AI Patents by Country

-

Economy2 weeks ago

Economy2 weeks agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

-

Wealth2 weeks ago

Wealth2 weeks agoCharted: Which City Has the Most Billionaires in 2024?

-

Technology1 week ago

Technology1 week agoAll of the Grants Given by the U.S. CHIPS Act

-

Green1 week ago

Green1 week agoThe Carbon Footprint of Major Travel Methods